According to the Australian Bureau of Statistics, the average household debt in Australia grew by 7.3% in 2021-2022. The same report also reveals that the average disposable income grew by 3.7%.

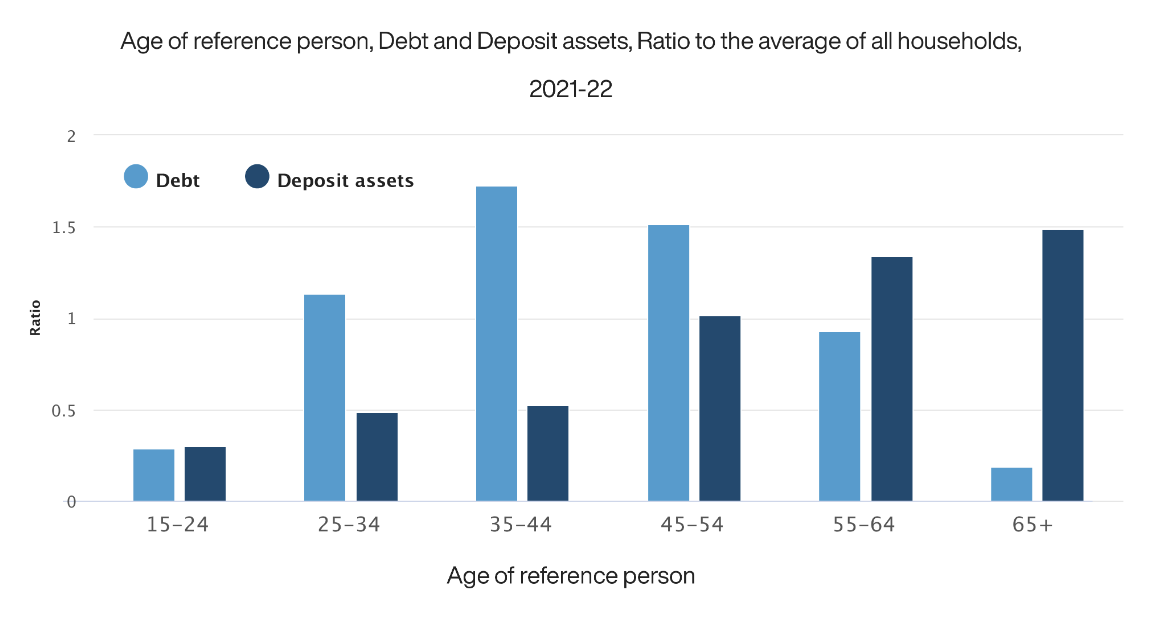

While deposit assets like savings and offset accounts have provided some buffer for liquidity for those largely between 55-64+ age groups, the debt-to-deposit asset gap for those between 25-54 years of age grew significantly.

From credit cards, Christmas shopping, and business equipment to cashflow needs, Australian debt has grown in size and type. It comes as no surprise that debt consolidation inquiries have risen significantly.

The power of a mortgage broker in this market

Due to businesses and individuals having to deal with multiple lenders, interest rates and fees left to manage various debts, Mortgage Brokers are vastly being recognised for their expertise and access to bank and non-bank lending facilities for consolidation.

People looking for better cash flow, one monthly payment and a little extra help are also looking for advice on managing their debt and its implications. To your clients, speed-to-market and sound advice, and serviceability are fast becoming a crucial part of why they choose to work with you over other brokers.

Australian Financial recommends reaching out to your clients to assess their needs and keeping in touch with them regularly as we enter a challenging economic climate.

#TIP: Always have a paper trail

It pays to ensure you document your conversations with your clients about consolidating their debt. Sometimes, you may be required to provide evidence of all your discussions with your clients. In that case, you can revisit your detailed notes, emails and correspondence to show that you have always done your due diligence as a mortgage broker and met your Responsible Lending and Best Interest Duty under NCCP

A range of products from lenders to appeal to your client's needs and financial status below:

Prime Full Doc Product - No DTI or CCR or CS <80% LVR, Cash out up to 90% LVR, Unlimited debt consolidation up to 90% LVR

Residential SMSF Loans now up to 90% LVR – SMSF Re-finance special – We will waive the Lenders Legal professional fees for all SMSF refinance applications received by 28th Feb 2023! Interest rate loading for an Offset account has been waived until the 28th of February 2023

Commercial SMSF Loans up to 80% LVR

Prime Residential – 98% LVR inclusive of LMI – Non-genuine savings acceptable

Prime Residential & Investment – including 85% LVR NO LMI product available

One Verification form on Prime ALT Doc

Up to 90% LVR on Specialist Clear ALT Doc

Offers listed on this website are correct at the time of publishing and are valid subject to the lenders’ criteria. Contact Australian Financial to learn about whether this offer is applicable and valid.